-

- About Us

- Products

Spend

ManagementAnalytics

Human

ResourcesSupply

ChainPricing Intelligence

Core

Cloud

- Services

- Industries

The (CPG) industry has rapidly evolved to meet consumer demands, thanks to digital technology allowing brands to carve out markets by selling directly to customers - from online orders and delivery to personalized meal kits and more.

Driven by the quest to improve market share, leading players in the CPG market are facing several challenges that are impeding business growth.

Today’s shoppers are more harried than ever before. Fragmented lifestyles demand of work and social pressures all mean that people have - or at least feel they have - less time. This drives more people to use subscription services, where they get everyday items. It is hard to influence shoppers to try new products, switch brands, or buy more with volume discounts and offers.

Anticipate and resolve supply assurance problems quickly with collaboration dashboards that alert you to supply and demand mismatches. Onboard all your suppliers using our on-demand tools, multiple integration options, and supplier enablement teams with decades of onboarding expertise.

The problem for grocery CPG firms is that the more consumers buy ready-made food, the less they need certain CPG products, like canned tomatoes or cooking oils. The impact of one individual consumer’s switch is small, but they collectively add up to a massive reduction in CPG product purchasing volumes.

Consumers have much more control in online channels than in stores.

The issue for CPG firms is twofold: they potentially lose sales to own-label products, and they run the risk of having to reduce their own prices, thereby compressing margins.

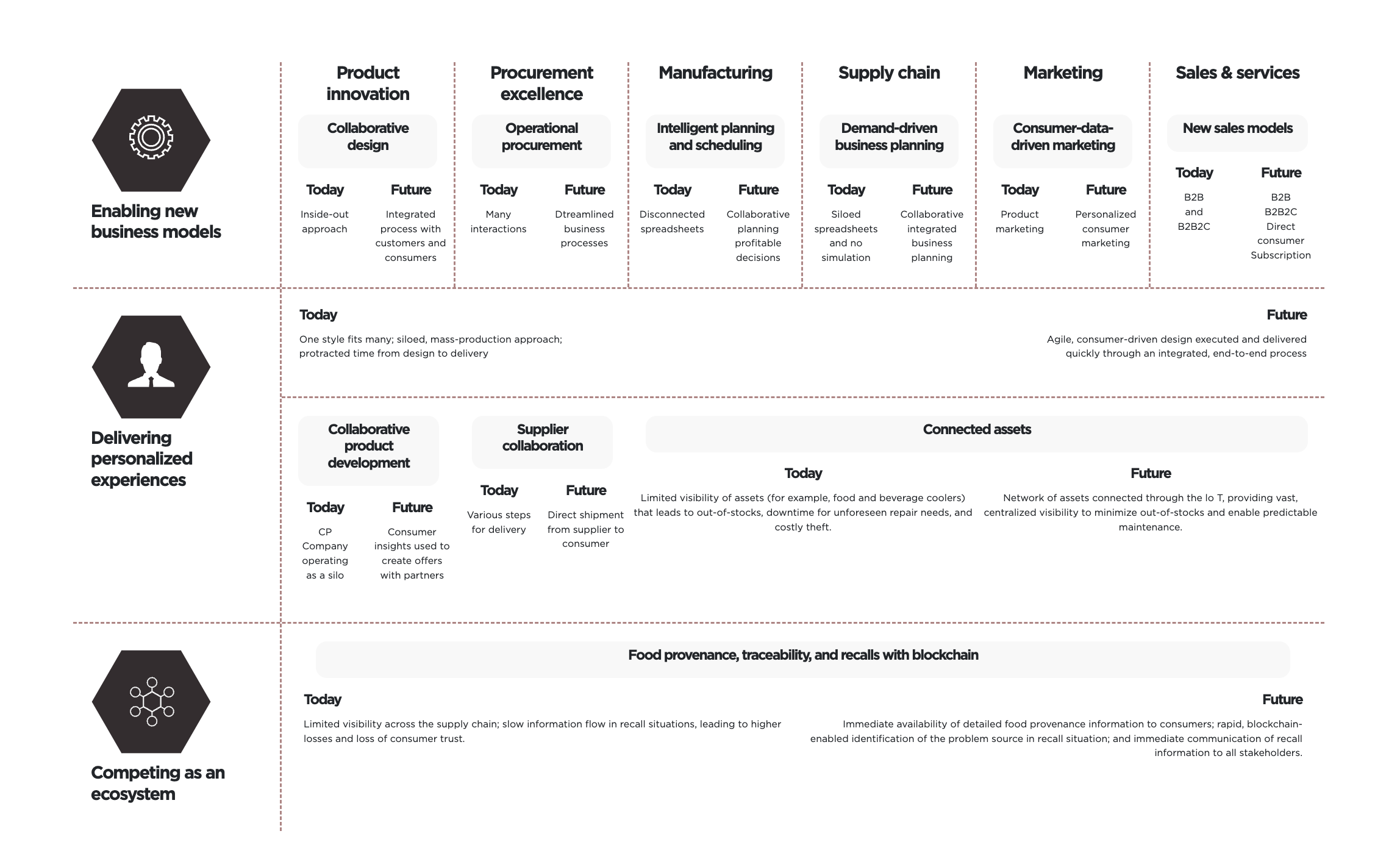

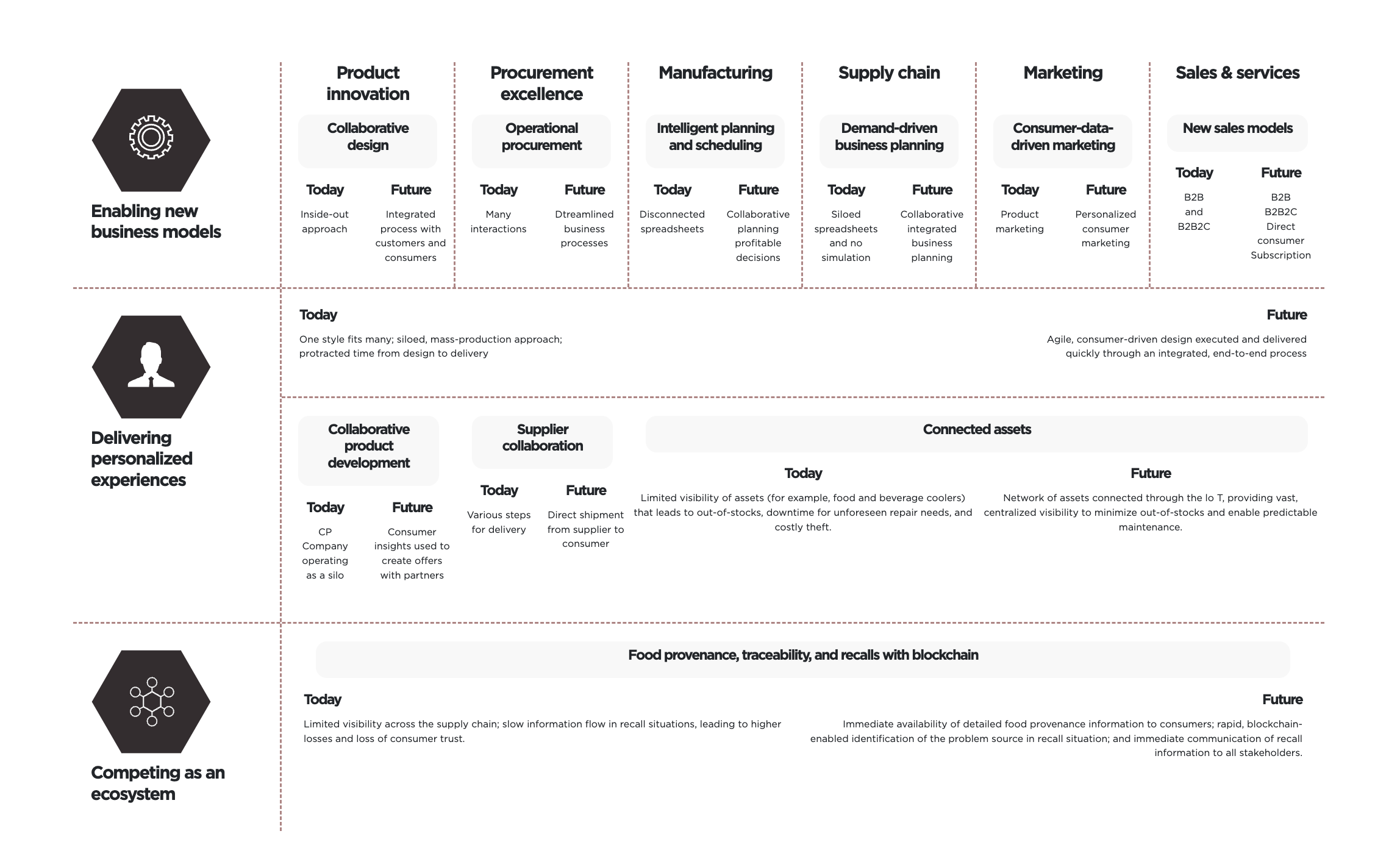

By 2025, we expect consumer product companies that can deliver more with less through automation and efficiency - redefining asset utilization, speeding up decision-making, and addressing evolving talent needs - to lead the way.

By 2025, we expect consumer product companies that can deliver more with less through automation and efficiency - redefining asset utilization, speeding up decision-making, and addressing evolving talent needs - to lead the way.

The companies on top will be those that can shift their core competency from selling to consumers to serving them. They will be able to continuously engage with consumers to unearth insights that can improve consumer experiences and outcomes. These companies will move from traditional consumer product retail value chain to focus on consumer outcomes such as health and wellness, security and control, social awareness, and more.

Today’s consumers have so many options - from product to channel to delivery - that they expect to be provided with choices that are best for them. This changing dynamic puts increasing pressure on consumer product companies to understand and engage with consumers on an individual level. In addition to these changing consumer dynamics and other related trends (illustrated below), tremendous volatility persists in basic costs - from raw materials and labor to shipping and beyond.

. Limited selection of high-volume items.

. Mass brand building and innovation for consistency and scale.

. Punishment for brands that undeperform; limited access for small and local brands.

. New channel and format growth.

. Explosion of SKUs resulting in increased cost and complexity.

. Conflicting channels - mass mechants, e-commerce, and discounters.

. Elimination of shelf space limitations through e-commerce.

. “Long-tail” opportunity for small, niche brands.

. Consumer confusion and frustration due to unlimited choices.

. Provide value throughout the consumer journey.

. Cater to the desire for flexibility, simplicity, and personalization.

. Deliver solutions rather than options - wht is best for the customer.

In short, consumers expect a new experience that makes their lives easier while being personal, relevant, and simple - where commerce is seamless; technology is invisible; and privacy, security, and trust are assumed and assured. Consumers do not want to be sold to or influenced. They want to be inspired, guided, educated, and helped, and will reward companies that differentiate based on personalized experiences and outcomes.

Delivery will require you to build new sets of competencies that traditional strengths. Such competencies include.

Crating new, engaging consumer experiences

Executing with speed and agility to exceed consumer expectations

Fulfilling demand seamlessly and efficiently

Delivering the end-to-end transparency that creates enduring consumer trust

Underpinning all these competencies is the crucial element of talent- because without the right people in the right roles enabled by the right tools, any effort to transform is bound to have only limited success.

SAP® Customer Experience solutions and the Intelligent Enterprise for the consumer product industry consistently offer a single, unified technology stack to streamline key processes, enable a single view of the consumer and deliver personalized shopping experiences.

The consumer has a single, treaded journey with inconsistent experiences. Confusing offers and messaging that is not targeted to consumer needs ultimately diminish consumer loyalty. This traditional experiences bases on:

Driven by the quest to improve market share, leading players in the CPG market are facing several challenges that are impeding business growth.

Siloed, expensive innovation strategy with sporadic new-item successes and huge investments in innovation for products where the majority of new items don’t last more than three years.

One-size-fits-all marketing strategy that wastes trade and marketing funds.

Limited visibility in-store conditions and consumer preferences and disconnect among channel partners that exacerbates out-of-stock conditions.

Disjointed e-commerce strategy that fails to capitalize on the growth potentials.

Personalized offers delivered in micro-moments mark the difference between a company making a sale

or the consumer making switch.

The new experience is based on:

Consistent master, customer (business-to-business[B2B]), and consumer (business-to-consumer [B2C]) data across all channels to enable consistent and meaningful experience

Full visibility of the entire value network, form sourcing and partner networks to in-store conditions and actual consumption.

Live access to, and use of, both structured and nonstructured demand drivers to assess market dynamics in real time.

Scaled, qualitative analysis of consumer experience sentiment and feedback to deliver a unified, personalized user experience.

SAP is enabling platforms for integration and collaboration that allow consumer product companies to compete as ecosystems. This not only means inter- and intra-company collaboration across functional units and among customers and suppliers; it also enables companies to leverage new distribution channels and new capabilities for supply network visibility such as connected assets, new avenues for consumer engagement, and trust through traceability and provenance.

Intelligent technologies enable great benefits, such as gains in productivity and efficiency, innovative new business models, and personalization based on deep analytics. The following key technologies are instrumental in helping consumer product companies realize these benefits.

Today, machine learning algorithms accomplish tasks that, until recently, only expert humans could perform. Advances are enabling machine learning to become highly accurate in natural language understanding, and in image and speech recognition.

Digital assistants and conversational user interfaces are already emerging as the next generation of support for customer interaction with businesses, ranging from simple customer service to more complex processes. In the consumer products industry, leading examples include invoice matching, claims matching, and virtual self-service.

The integration of advanced analytics capabilities into applications enables business users to analyze transaction data on the fly and drive better decision-making. This occurs through proactive, embedded, predictive analytics that empowered users can use to simulate the impact of business decisions and achieve better customer outcomes.

NXSYS has aided many CPG companies in achieving their goals. For example, Hayatna is a leading manufacturer and distributor of packaged foods and beverages. They offer better-for-you, natural and organic products.